It’s no secret that the longer you can retain customers, the more revenue you can generate. And there’s a metric that combines the profitability and time of the customer’s association with your brand. That’s right! Customer Lifetime Value or CLV.

Customer lifetime value (CLV) helps to evaluate your customers based on a long-term relationship instead of individual transactions. It estimates customers’ current value and lets you predict their future purchase capacity.

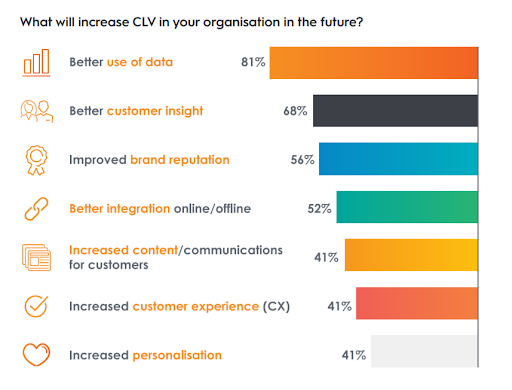

According to a report by Criteo, 81% of the companies that actively monitor the CLV generate more sales than 57% who don’t.

But customer lifetime value (CLV) can do so much more as a business KPI:

- Predict customer loyalty

- Measure profitability over time

- Measure the health of your customer relationships

It means you can easily forecast the revenue and profits for the next quarter or year and make decisions accordingly.

The biggest question is – How?

And that’s why we have crafted this blog to help you create a working customer lifetime value model in your business. We will go through the methods to calculate CLV and provide targeted strategies to boost it for your brand. We also have detailed how real brands use customer lifetime value (CLV) to improve conversions and customer retention.

Let’s begin!

What is CLV: Definition!

Customer lifetime value (CLV) or lifetime value (LTV) calculates the total worth of your customers over their entire business lifetime. It’s defined as the total profit your business is estimated to earn from a given customer from acquisition until they leave the business.

The importance of CLV lies in the fact that it collates two important factors into one – the average revenue per order from a customer and the total time they spend with the brand.

So, if you can increase one of these factors, the net effect trickles down to an increase in the revenue generated and average retention rate.

It also helps balance the cost between retaining existing customers and acquiring new ones.

Let’s understand this with an example:

Suppose the customer acquisition cost from your ad campaigns is $900, and the total estimated revenue or CLV from an acquired customer is $700.

It means that even though you are acquiring new customers, you are losing money at $200/customer in the long run, which is NOT good for your business.

With this information, you can now either plan to:

- Reduce the spending on marketing

- Or increase the net profit from customers

By calculating the CLV, you can develop your acquisition strategies based on the profit you intend to make from your customers.

Why is it Important to Calculate Customer Lifetime Value?

Calculating customer lifetime value lets you make data-based decisions on how much you should spend on new customers and how much to invest in retaining the existing ones.

The question is – why should you care about CLV and go through all the efforts to monitor it. Here’s why:

Compare the Customer Acquisition Cost & Estimated Revenue/Profit

Customer Acquisition Cost (CAC) is the amount spent to convert a prospect into a customer. Not all customers are equals. That’s why businesses often deploy multiple marketing strategies to bring in new customers, which requires resources and time.

But how does it relate to Customer Lifetime Value (CLV)?

As mentioned above, CLV indicates how profitable a customer would be during their relationship with the business.

CAC and CLV share a close relationship and are usually expressed as a ratio – CLV: CAC. The higher the ratio, the better it’s for your business.

Using the ratio, you can compare the acquisition cost of each customer and their expected profit from different marketing channels to manage them more effectively.

It also helps you to cap the spending on the marketing campaigns to keep the CLV: CAC ratio above 1.

It’s one of the essential steps for startups to estimate the upper limit of their expenditure and prevent uncontrolled spending on rigorous acquisition schemes that may not provide adequate returns.

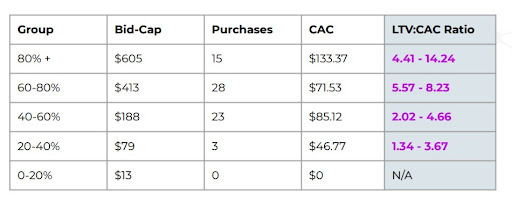

Case Study – How Ritual used LTV: CAC ratio to optimize its customer acquisition strategies

Ritual, a leading vitamin supplement brand, was looking to acquire high-value customers and lower the customer acquisition costs on its current marketing campaigns.

Team A/B tested the following two Facebook campaigns:

| Campaign Name | Bidding parameters | Acquisition Cost | LTV: CAC ratio |

| Business as Usual (BAU) campaign | Targeted new customers based on current high-value customers. | $114.26 | 3.03 |

| Retina Value-Based Lookalike Audience (VBLAL) campaign | Provided Facebook with bids based on the LTV scores of current customers so it could find similar users with higher LTVs and exclude others. | $88.82 | 4.16 |

The acquisition costs for BAU and VBLAL campaigns were $114.26 and $88.82, respectively. The resulting LTV: CAC ratios for the two campaigns were 3.03 and 4.16.

Clearly, customer lifetime value-based bidding campaigns provided higher returns on investments.

Ritual bid capped successive campaigns using the LTV:CAC ratio from the A/B test to lower the acquisition cost and keep the ratio higher.

It identified different customer segments and capped their bids based on their LTV: CAC ratios as shown in the image below:

The campaigns resulted in an average acquiring cost of $88.43, ensuring higher profitability for Ritual.

Identify Important Customer Segments

The CLV: CAC ratio becomes more important when we look into the Pareto principle, which states that 80% of your profits come from 20% of the repeat customers. And increasing retention by just 5% can boost your profits by 25% to 30%.

These statements make retention a priority for any business, and it begins by identifying the most critical customer segments.

You can start by grouping the customers based on attributes like age, location, purchase behavior, and others.

- By calculating CLV for various groups, you can find the segments that can bring in higher profits and double down on your efforts to increase the retention rate of these high-value customers.

- But CLV also lets you look past the top tier and focus on low-level customers that may not have high average order value but can provide more profits over the long term. You can then develop strategies to build long-term relationships and nurture these customers.

Perform Value Segmentation

Value segmentation is another crucial aspect of calculating the customer lifetime value (CLV) for your customers. It lets you group customers based on their revenue potential and loyalty towards the brand.

We saw earlier how Ritual used value-based segmentation to find out the spending budget for each new customer for lowering the overall acquisition cost and increasing the CLV: CAC ratio.

It can also help you identify various customer groups like the regular customers, those with the tendency to churn, and the least profitable ones. You can then deal with each segment individually.

For example:

- Customers who haven’t purchased in the last 3 to 6 months carry a high risk of churn. So, you can create special offers to convince them to make a purchase.

- Reach out to high LTV customers with an estimated purchase value of $10000 or more with membership and saving options on their subsequent purchases.

Segmenting customers based on their estimated value can help you target them with personalized campaigns to increase the overall customer lifetime value.

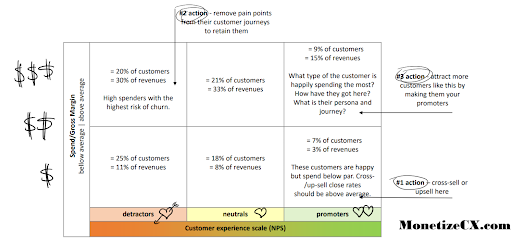

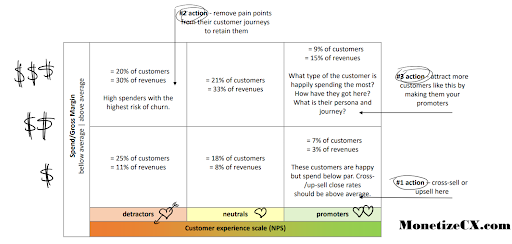

Case study: How MonetizeCX used value segmentation to target different customers.

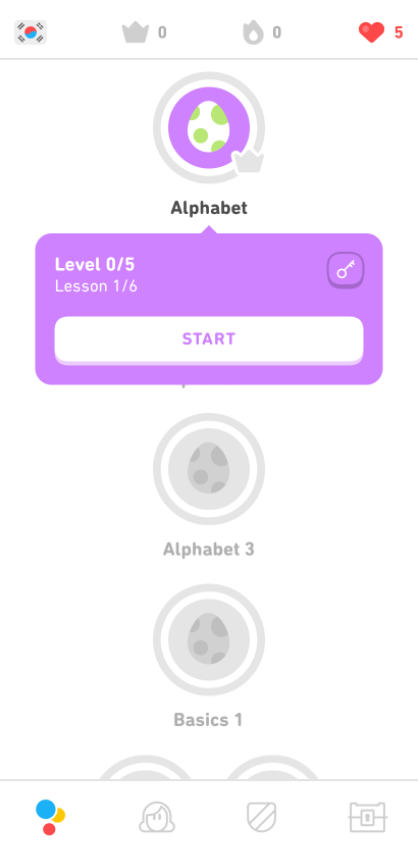

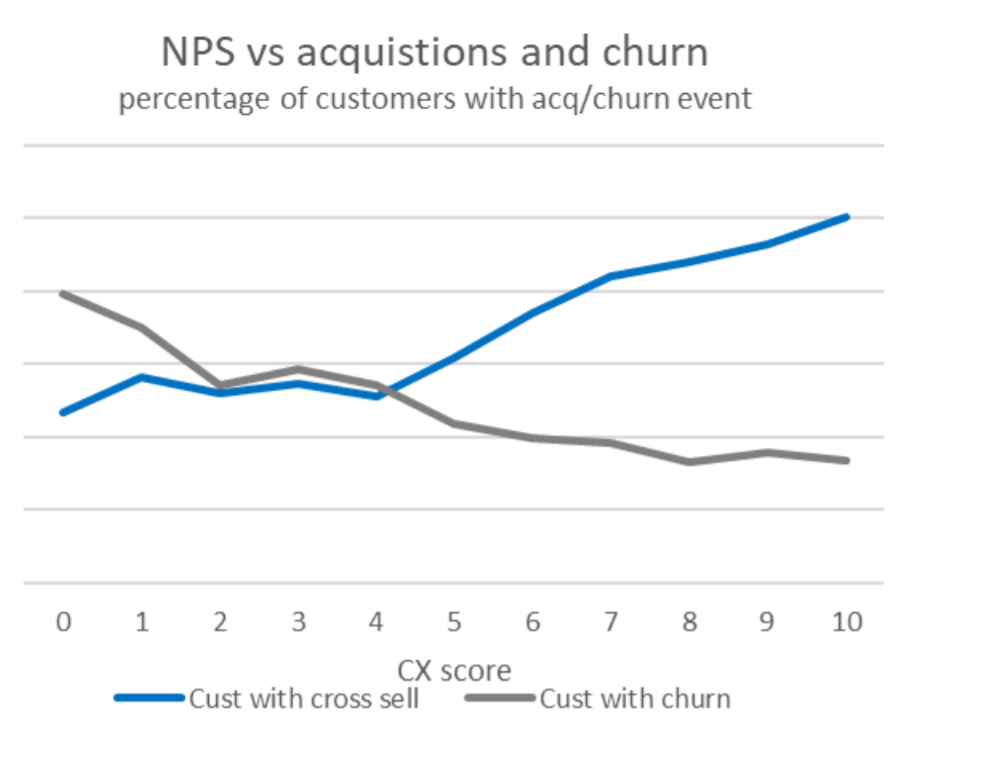

Let’s look at the case study by MonetizeCX to understand how they used the CX score-spend segmentation matrix to explore upselling and cross-selling opportunities, improve retention, and increase acquisitions.

Here’s what they did as shown in the chart above:

- Provide upselling and cross-selling opportunities to the customers with below-average spending but a high CX score (promoters) to increase average order value.

- Reach out to the customers with above-average spending and high CX score (promoters), and make them brand ambassadors to bring in new customers (acquisitions).

- Target detractors with above-average value to address their pain points and increase retention rate.

The overall results of the efforts:

- Identification of different customer segments based on CLV.

- 11% decrease in the CAC in a few weeks.

- 4% increase in the CLV from top-tier customers in a few weeks.

Revenue Forecasting

Customer lifetime value depends on different factors – average purchase value, purchase frequency, and probability of repurchase.

If you host a SaaS-based product or offer subscription-based pricing, monitoring CLV is essential to forecast your monthly or annual revenue from different customer types.

With statistical analysis, you can calculate the expected revenue from your current customer base. It helps to set a long-term vision for your products and services.

Since recurring revenue comes from customers you have already retained, you are not spending more money to acquire them again. It helps to increase the overall profit margin.

Measure the Performance of Your Marketing Campaigns

Another important reason to work your way through the customer lifetime value calculation is to measure your marketing campaigns’ performances. Again, you can look at the CLV to CAC ratio to evaluate the most successful campaigns that bring in more customers at a relatively lower expenditure.

Suppose the CLV: CAC ratio for your landing page campaign, which targets prospects at the end of the conversion funnel, is 2:1. It means that customers you acquire through this campaign are expected to provide twice the value you spent on converting them.

In the same way, you can use value segmentation across different customer attributes like channels, customer type, campaign type, and others to find the right outlets for running the most effective marketing campaigns.

Case Study: How FAMBrands increased its campaign performance by 20% using customer lifetime value(CLV)-based targeting

FAMBrands, a leading sportswear manufacturer, wanted to calculate the value of its existing customers and use the attributes of the highest value customers to acquire new ones.

FAMBrands used the RetinaGo tool to analyze its current customers and segment them based on their predicted lifetime value and churn rates. It helped the brand to develop customized value-based Facebook bidding campaigns to find similar new customers.

The brand saw an increase of 20% in campaign performance during its busiest time of the month, which equated to 1.25 times the regular annual returns on their ad spends.

6 Advantages of Calculating Customer Lifetime Value(CLV)

It’s necessary to design and develop a CLV-based model in your business to maximize the value of existing customers and the new target market. Doing so provides a number of benefits such as:

Streamline Cost Management

Cost savings is one of the primary benefits of calculating customer lifetime value(CLV). A well-known fact is that it’s at least five times cheaper to retain old customers than to acquire new ones.

CLV lets you look beyond aggressive acquisition campaigns and focus on unutilized areas with the probability of higher returns using smaller highly-targeted strategies. It helps you to find the answer to the following questions:

- Estimate the cost of acquiring a new customer

- Size of investments to retain the customers

- Keep the acquisition cost as low as possible while increasing the overall profit

- Develop personalized offers suited for different customers

In this way, you can spend less time acquiring new customers with lower value and nurture the high-value existing ones to balance the overall CLV: CAC ratio.

Build Better Customer Relationships

Calculating CLV opens up retargeting opportunities with different customer segments to increase retention rate and average order value. It lets you create hyper-targeted interactions to build long-term relationships with customers rather than just satisfying them.

With value-based segmentation, you can cater to segments with a higher probability of repurchase and retention to improve the revenue further with personalized interactions.

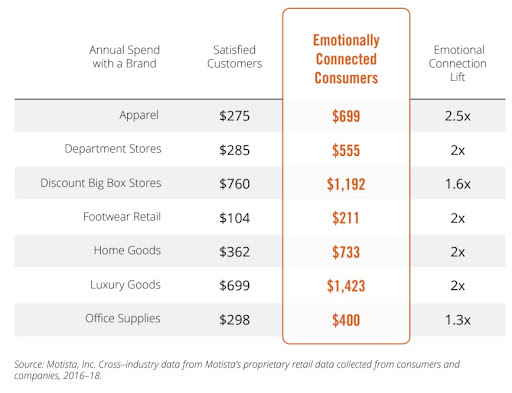

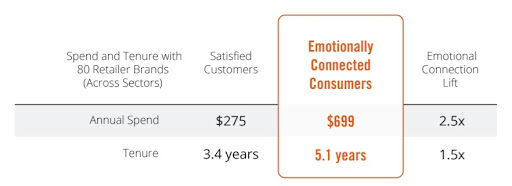

A study by Motista also states that emotional bonds last more than mere advocating satisfaction. Motista collected data from 100,000 US-based customers from over 100 brands analyzing their spend level, lifetime value, brand loyalty, and advocacy.

- It was observed that customers who are emotionally connected with a brand spend twice as much as satisfied customers.

- What’s more, emotionally motivated customers have a 306% higher lifetime value and 1.5 times longer lifespan than merely satisfied customers.

So, by focusing on increasing CLV, you can build emotional connections with customers to unlock the growth potential.

Improve Customer Loyalty

Another important benefit of calculating customer lifetime value is improved customer loyalty. Two of the main aspects of calculating customer lifetime value are purchase frequency and customer lifespan.

It means that to increase CLV, we need the customer to make repeated purchases over time. This behavior itself is a marker of customer loyalty. If we can sustain it over the expected customer lifespan, we can earn loyal customers and brand promoters.

There are multiple ways to build long-term customer loyalty and increase CLV, such as:

- Giving away rewards and discounts.

- Optimizing customer experience during their journey.

- Gathering customer feedback to address their issues and pain points quickly.

- Collecting and tracking satisfaction scores like NPS, CSAT, etc., to see real-time improvements in customer sentiment and satisfaction.

- Providing effortless customer service interactions.

Decrease Acquisition Cost

Uncontrolled Acquisition cost is often cited as one of the main reasons for the failure of startups because such companies are unable to recover the expenditure from the acquired customers.

That is where the CLV: CAC ratio again comes in handy.

Calculating the average customer lifetime value for different customer segments can provide a clearer picture of which customers to focus on to maximize profit and reduce the cost of acquisition.

It also lets you intelligently allocate resources to different customer segments:

- You can design extensive campaigns to retarget high-value customers that bring higher profits and allocate a smaller portion of your budget towards low-yielding customers.

- What’s more, you can funnel your budget more carefully towards acquiring new customers depending on the predicted return on investment.

Even if the initial cost of acquiring a new target market is higher, you can balance it with the profits from high LTV customers to control the overall acquisition cost.

Case study – How Marin Software helped SurveyMonkey double their international spending by increasing the LTV by 150%

SurveyMonkey, a leading survey tool, wanted to assess the performance of their paid search campaigns in generating account signups for their three pricing tiers – Good, Platinum, and Select. They initially used the CPA (cost of acquisition) metric to regulate the campaigns, but it proved inadequate as it treated all customers equally.

So they decided to switch to LTV, which worked by estimating the potential revenue from each customer and provided better segmentation.

They used Marin’s custom revenue model to assign LTVs to all the account signups across the three pricing tiers.

It helped them optimize their campaigns across different geographies by aligning the geo-targeted campaigns with the relevant customer LTVs. Marin’s automated algorithm also helped SurveyMonkey find high-value keywords based on projected LTV.

These keywords were initially attributed to higher CPAs and thus not picked up. By optimizing the keywords, the brand increased its overall LTV by 150% for international campaigns and doubled its spending.

Predict & Reduce Customer Churn

Higher customer retention rate is another outcome of calculating customer lifetime value and improving it over time. It lets you see early signs of customer churn and take necessary actions to retain the customers.

There are two types of churn behavior – voluntary and involuntary.

Voluntary churn is when a customer actively stops from a brand or cancels the subscription. It may be due to dissatisfaction with the product or not getting the expected value for the price. Involuntary churn can result from payment failure, insufficient funds, server error, or other unexpected reasons.

By combining CLV with other metrics like CX score and purchase history, you can see which churned customers hold the potential to bring in higher profits if they are successfully retained.

How can CLV help to predict churn probability?

- Identify customers with high order value and high predictive CLV who haven’t purchased for some time, say the last 90 days.

- Map customers who have above-average purchase value but are unhappy with your business.

- Map long-time customers who canceled their subscription in the last 1-2months.

Once you have the list in hand, you can now use different strategies to retain them.

For a real-world example, let’s go back to the MonetizeCX case study:

Here are some observations:

- We can see that they combined the customers’ average spend values with the NPS survey feedback to identify customers with high churn risk.

- What’s more, it helped to focus their efforts on specific customers who can provide better ROI instead of targeting all the detracting customers. It translates into overall reduced acquisition and retention costs.

Improve Sales

Better customer lifetime value means higher average order value (AOV), increased customer lifespan, highly personalized marketing campaigns, and reduced acquisition costs, resulting in improved sales and conversion rates.

Hyper-Targeting With Granular Segmentation

Value-based segmentation can do much more than just provide upselling opportunities. Once you have the numbers, you can target different segments with niche strategies.

For example, if you have a specific segment that purchases often but has a lower average order value, you can send them discount codes and vouchers to help improve the purchase value. Or, if you host a SaaS-based product, you can create custom pricing options for such users to encourage them to upgrade the plan.

So it works for verified customers at the bottom of the sales funnel. But what about prospects and potential customers?

Well, you can extrapolate the same trend backward.

By building customer personas or ideal customer profiles (ICPs) for users with higher CLV, you can focus on prospects with the same technographic background, share the same interests, or look for similar solutions.

It can help you cut through the clutter and bring in more high-value customers that fit your target audience.

Prioritize Optimization & Issue Resolution

All customers are important. But you have to agree that some bring in more revenue than others. It becomes important to deal with such customers on a priority basis and only then look further.

Here’s a simple example of how CLV can help with faster product optimization:

Suppose you get separate complaints from two customers about different issues. One customer is a premium user who’s been with you for the last two years, and the other is using your free plan.

Both of these complaints are equal, but when you see a VIP tag next to the complaint ticket, you can devote extra resources to handle this complaint on priority.

With a dedicated CLV model, you can identify product and process issues impacting high-value customer segments. Then, try to resolve it. Test your ideas with these segments to see if they add value to their experience.

Even if a product-level issue impacts several customers, first update high-value customers about the progress to avoid churn and negative feedback.

What Do You Need to Calculate CLV?

Before we get into the customer lifetime value calculation, let’s define some variables that we would need in the process. To keep it organized, we will calculate the value for these variables in this section using a hypothetical example and then plug them into the relevant CLV formula in the following section.

Note: Keep the time consistent for all calculations, i.e., weekly, monthly, or yearly. We have used the monthly average to find the value of all the variables.

Suppose an online business wants to calculate customer lifetime value using the following data from the last six months:

| Month | Revenue | Cost of goods | Gross margin | Total orders | Number of unique customers | Purchase frequency |

| Jan | $9000 | $7000 | 0.22 | 47 | 37 | 1.27 |

| Feb | $11300 | $8200 | 0.27 | 55 | 35 | 1.57 |

| Mar | $9400 | $7300 | 0.22 | 44 | 38 | 1.15 |

| April | $12500 | $8500 | 0.32 | 58 | 46 | 1.26 |

| May | $9500 | $7400 | 0.22 | 45 | 32 | 1.41 |

| Jun | $10700 | $7900 | 0.26 | 51 | 38 | 1.34 |

| Total | $62400 | 46300 | 300 | 226 |

Average Order Value (AOV)

The average order value is total revenue during the period divided by the total number of orders during the same period.

Here,

Total revenue = $62,400

Total orders = 300

Then,

AOV = 62,400/300 = $208

Average Purchase Frequency (F)

Average purchase frequency is the number of transactions(orders) per customer per period.

Purchase frequency per month = total orders in the month / total monthly unique customers

Then,

Average purchase frequency (F) = [1.27 + 1.57 + 1.15 + 1.26 + 1.41 + 1.34]/6 = 1.33

Churn Rate

The churn rate per month is the number of customers that stopped doing business with a brand in a month.

To calculate the churn rate for a month, take the number of customers you lost during the month and divide it by the total number of customers at the beginning of the month.

For this example, let’s say the churn rate per month is 5%

Average Customer Lifespan (ACL)

The average customer lifespan is the time for which the customer remains with the brand. It’s the reciprocal of the customer churn rate.

Here,

ACL = 1/0.05 = 20 months

Average Gross Margin (AGM)

The average gross margin is the profit earned after deducting the cost of goods sold. It’s expressed as a percentage.

Average gross margin = {(Total revenue for the period – total cost of goods sold)/ total revenue } x 100

Here,

Average gross Margin (AGM) per month = (0.22 + 0.27 + 0.22 + 0.32 + 0.22 + 0.26) / 6 = 0.25 or 25%

- Gross Margin Per Customer Lifespan (GML)

Gross Margin Per customer lifespan = Average profit margin x Average total revenue per customer over their entire lifespan.

Let’s say that the company earns a total revenue of $4160 from each customer. (See calculation from the aggregate model in the next section)

Then. GML = 0.25×4160 = $1040

Retention Rate

The retention rate is the percentage of customers a business retains over a given period.

The retention rate per month equals the number of customers that stayed at the end of the month minus the number of customers you acquired during that month divided by the number of customers at the beginning of the month.

Let’s say the retention rate for this example is 80%.

Discount Rate

Discount rate evaluates the value of customers’ future cash flow based on the time value of money. It’s used to estimate the value of the future profits from the investments in the company’s campaigns today.

Let’s take the discount rate for this example as 10%.

How to Calculate Customer Lifetime Value (With Example)

Now, it’s time to calculate the CLV by plugging the values of the variables we calculated in the previous section. There are multiple methods to calculate the customer lifetime value. Often companies use one or more methods simultaneously to estimate the true worth of their customers.

Let’s see three simple CLV calculation models:

Aggregate Model / Simple Historical Model

This method takes customers’ past behavior and purchases to calculate their estimated value. It’s one of the most straightforward approaches to calculate the CLV and is appropriate when the variables are roughly constant over time.

| CLV = (AOV x ACL) |

Then, using the variables from the last section:

CLV = 208×20 = $4160

Predictive CLV Model

The predictive CLV model is more accurate than the historical approach. It tracks customers’ transactions to monitor changes in their behavior over the desired period to predict the customer lifetime value.

Here is the simplest formula for Predictive CLV calculation:

| CLV = (F x AOV x AGM x ACL) |

Then,

CLV = 1.33 x 208 x 0.25 x 20 = $1383.2

The main drawback of this method is that it does not consider market inflation. That is where the traditional approach comes into play.

Traditional CLV Model

The traditional CLV model is useful when your sales figures fluctuate with time. It also modifies the CLV formula to adjust for yearly inflation. This model is more accurate than other methods discussed above.

| CLV = (GML x R) / (1 + D – R) |

Then,

CLV = (1040 x 0.80) / (1 + 0.10 + 0.80) = $2773.3

So Many CLV Calculations!!! But Does it All Mean?

From the above formulae, we have three CLV values:

- $4160

- $1383.2

- $2773.3

If we take the average of the three CLV values, we get $2772.16.

It means:

- You stand to make over $2500 from each customer over the period of just 1.6 years.

- We calculated the CLV for all the customers. But if you segment your users based on their AOV, you can measure how much more revenue your top customers generate than the average ones.

- Let’s say the CLV for the top customer segment comes out to be $3500. It means you are making $700 more from each top-tier customer. So, even if it costs more to acquire and retain such customers, it’s worth the effort.

Wait there’s more:

- The CLV calculation had two main components, average order value (AOV) and average customer lifespan (ACL). If you run segmented CLV calculations, you can develop strategies to increase these two variables to boost CLV for each segment.

- Say, your average acquisition cost (CAC) per customer is $500. Then, the CLV: CAC ratio comes around 5.5. With the estimated profit in hand ($2700), you can increase the budget capping on your marketing campaigns as long as this ratio stays above 1.

- You can also allocate a budget to acquire new target markets or advertise on new channels to bring in more customers.

Here is an infographic that shows the CLV calculation for Starbucks using the Aggregate, Predictive and Traditional methods:

10 Ways to Boost Your Customer Lifetime Value (CLV)

Calculating the customer lifetime value is just the first step towards sales optimization. Once you have the estimated numbers, the next step is to develop strategies to increase the average CLV to improve the retention rate and reduce acquisition costs.

Let’s see some of the ways to boost your CLV:

Introduce Membership & Reward Programs

Rewards and membership programs are among the best ways to increase the CLV because they encourage customers to repurchase. It means you can achieve both customer retention and an increase in average order value by offering rewards.

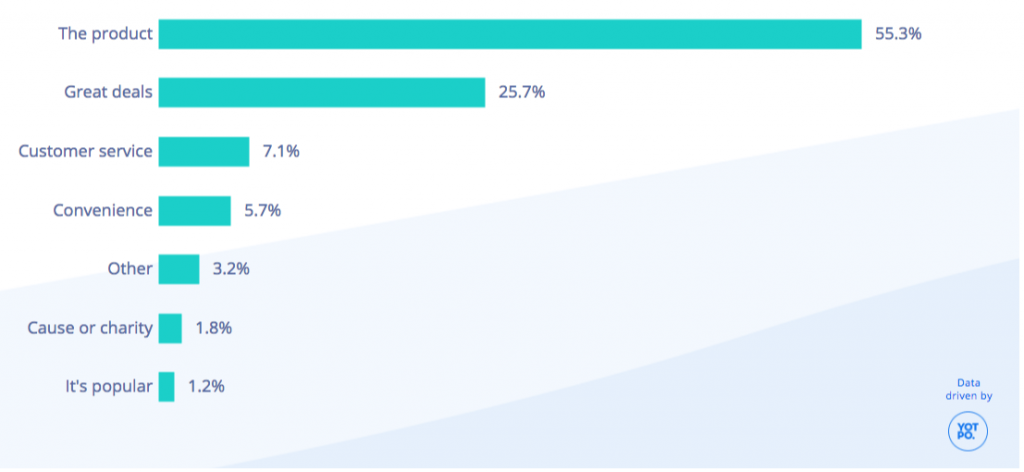

According to a 2018 survey by Yotpo, great deals rank second among the top reasons a customer is loyal to a brand.

Here are some other stats that show that customers also expect some sort of reward for regular purchases from a brand:

- 52% of American customers will join a loyalty program with a preferred company.

- 60% of customers say unexpected rewards are the biggest reason they’ll stay loyal to a brand.

- 75% of buyers are likely to make another purchase after receiving an incentive.

But how to do it?

- Start by segmenting your high-value customers based on the total LTV, the number of purchases, or purchase frequency.

- Set up membership program rules. There are different tools like ReferralCandy that you can use to launch your membership program.

- Set up an email campaign or use SMS to send the rewards program notifications. You can also show the exclusive membership offer in selected customer accounts via banners.

- Offer cashback or discount on purchases above a certain amount. Cashback is a more preferred mechanism as it acts as an incentive for customers to come back.

- You can also give away complimentary products to entice customers.

Few tips to optimize your usage of the membership credits:

- Assign urgency to use the cashback or credits by adding an expiry date.

- Set up automated reminders for customers when their points are about to expire.

- Set up a system so the customers can track the available points in their website account or app.

Optimize Customer Onboarding

Customer onboarding not only improves product adoption but also impacts customer retention, as evident in the image below:

We can see that a positive onboarding experience can increase the retention rate by 6% even after nine weeks of using the products and services. A higher retention rate means an increase in recurring revenue, which directly impacts the customer lifetime value.

That’s why it’s essential to design a great onboarding experience for your customers, especially for brands offering freemium accounts and SaaS-based products.

Duolingo – A fantastic onboarding example

Duolingo is a freemium-based language platform that helps users in learning new languages. The platform features a highly user-friendly onboarding process that instantly hooks the users.

You can explore the features without creating an account. The app takes you through the tour when you download it for the first time.

You are asked to choose a goal and skill level to experience a personalized app tour.

Depending on the choices, you are sent to the dashboard to experience the product features. You can do the learning exercises, learn how XP works, and explore other small features.

It promotes gradual adoption of the app instead of throwing everything at once at the users. The signup prompt is displayed only at the end of the onboarding process once the user is completely engaged with the app.

The onboarding process is fun, intuitive, and user-friendly.

Hear the Voice of Customers – Prioritize CX Optimization

Customer experience optimization is an integral part of improving customer lifetime value by promoting long-term customer loyalty and retention.

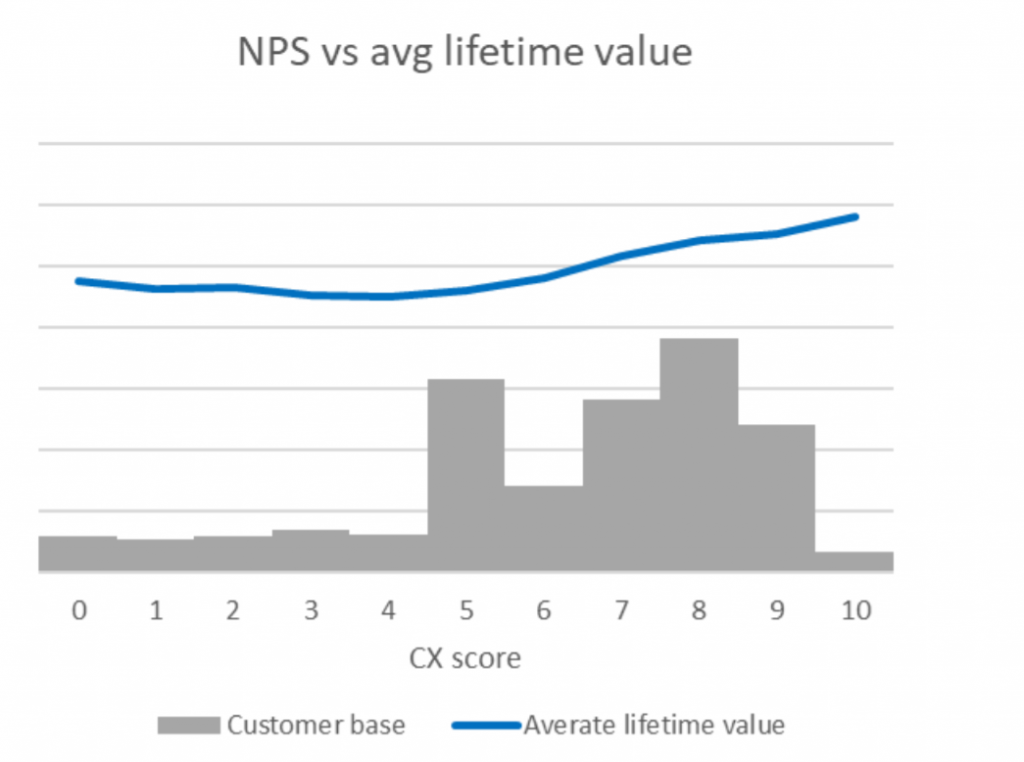

Let’s go back to the case study by MonetizeCX on the impact of the customer-centric approach on customer lifetime value. It clearly indicates the impact of a high NPS score on CLV. The results show an increase of 6% in spending among happy customers and a drop of -4% among customers with the lowest CX score.

It means CX experience optimization is a crucial factor for boosting average customer lifetime value, building healthy relationships, and promoting your brand.

But how do you start the CX optimization process?

By hearing what your customers have to say about you.

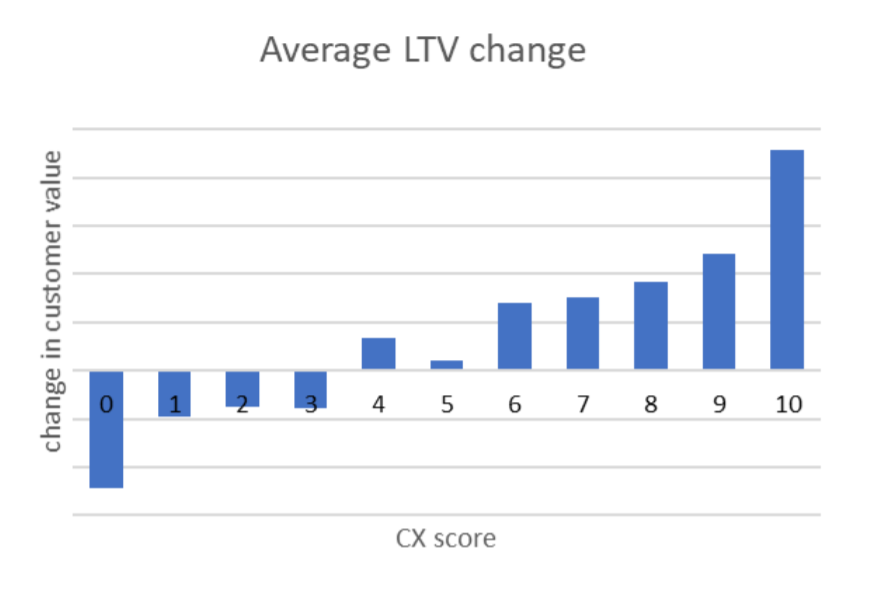

57% of marketers believe that collecting customer feedback is the most important tactic to improve CX.

Installing effective feedback systems at various stages of their journey can help you collect valuable insights about customers’ issues, pain points, brand expectations, and delights.

You can then take the necessary steps to address these issues and improve the transactional and overall customer experience.

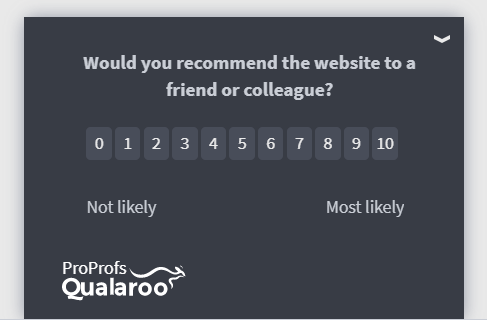

For example, you can use surveys to collect customer satisfaction metrics and other feedback data. It will help you to track the score over time to see if your optimization efforts are working or not.

In the same study by MonetizeCX, we can observe the impact of one such metric – NPS on acquisitions and churn rate.

The study found that happy customers are more than twice as likely to buy another product within a year and 60% less likely to churn than unhappy customers.

What’s more, attaining a higher NPS can also help boost your average CLV, as seen in the image below:

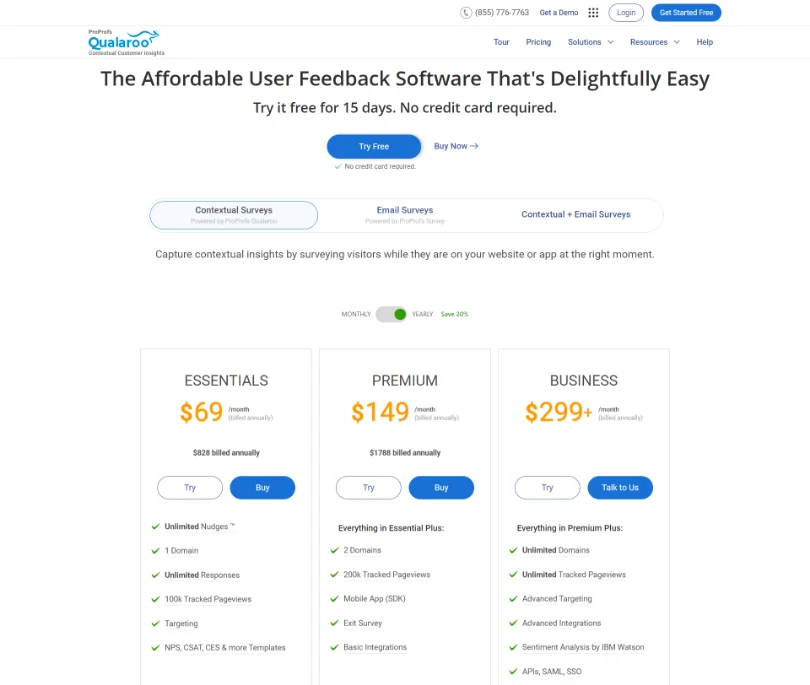

How to hear the voice of your customers?

- Use advanced user feedback tools like Qualaroo to set up a voice of customer program in your business.

- Design surveys such as NPS, CSAT, CES, exit intent, and others to collect targeted feedback from desired customers.

- You can deploy surveys on different channels like embedding them on the website or mobile app, sending them through email or SMS, or sharing the surveys on social media via shareable links.

- Today, feedback tools also support advanced analysis techniques like sentiment analysis and text analytics to reduce the time to mine the feedback. In this way, you can act on the insights quickly to design the best possible customer experience.

Case Study – How AWA digital helped Avis to increase average order value(AOV) per customer with experience personalization using customer feedback

Avis, a leading car rental company, wanted to deliver a better customer experience than its competitors by offering relevant add-ons to the customers, such as navigation systems, child seats, insurance, and more.

So they hired AWA digital to promote the awareness of these add-ons among the customers and increase the overall revenue per customer.

AWA digital implemented a customer feedback program to understand which add-ons were most popular among the users and the reasons behind their choices.

The team used the feedback data from targeted surveys to identify the most sorted upgrades among the users. Based on the insights, they tested the hypothesis of adding an interstitial pop-up before the booking stage to show these upgrades to the customers.

With this small change, the team saw a dramatic increase in the sale of add-ons items and revenue per customer.

Install & Optimize Service Touchpoints

Service touchpoints are another vital aspect of CX optimization that can help you produce happy customers to promote a positive brand experience.

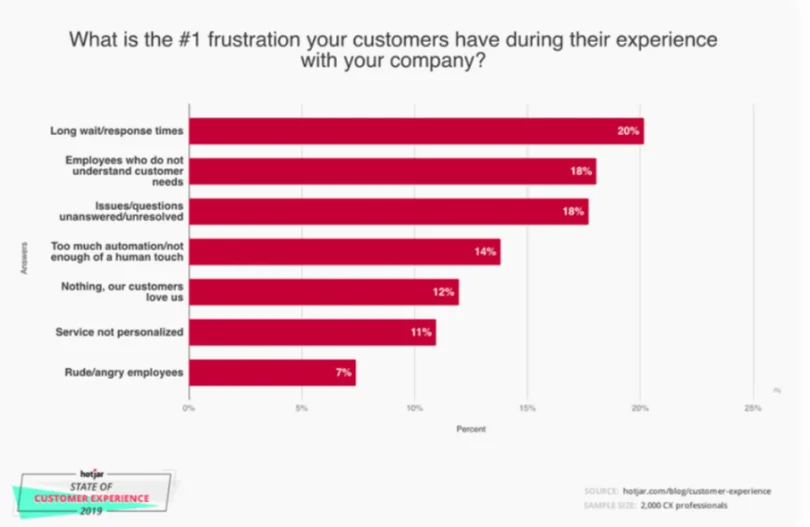

According to a survey by HotJar, long waiting queues/response time is the most frustrating point for customers during their experience with the brand.

And that’s not just a statistic. Haven’t we all been there and felt that? Remember how helpless it feels when you need a resolution and have to wait endlessly for a resolution?

Combining this with the fact that 67% of the customers prefer self-service channels over speaking to customer representatives, we can see the importance of setting up an optimized omnichannel service experience for your customers.

How to optimize customer service touchpoints?

- Add a live chat widget to your website or app to relieve pressure on the support staff. You can also integrate AI chatbots to provide 24/7 live chat support

- Set up a knowledge base section to create product guides, help articles, product training blogs, FAQs, and other self-help materials for the customers.

- Install a help-desk system to provide support over email to reduce overall call flow and improve TATs.

- Deploy post-interaction CSAT surveys through phone IVR, live chat window, or email to gauge the effectiveness of the support agents.

- Use a robust service platform to track metrics like average response time, time on call, average customer satisfaction ratings, and the number of calls handled per day. It will help to estimate the load on your support staff and monitor their efficiency.

Target Behaviour & Actions – Prioritize Personalization

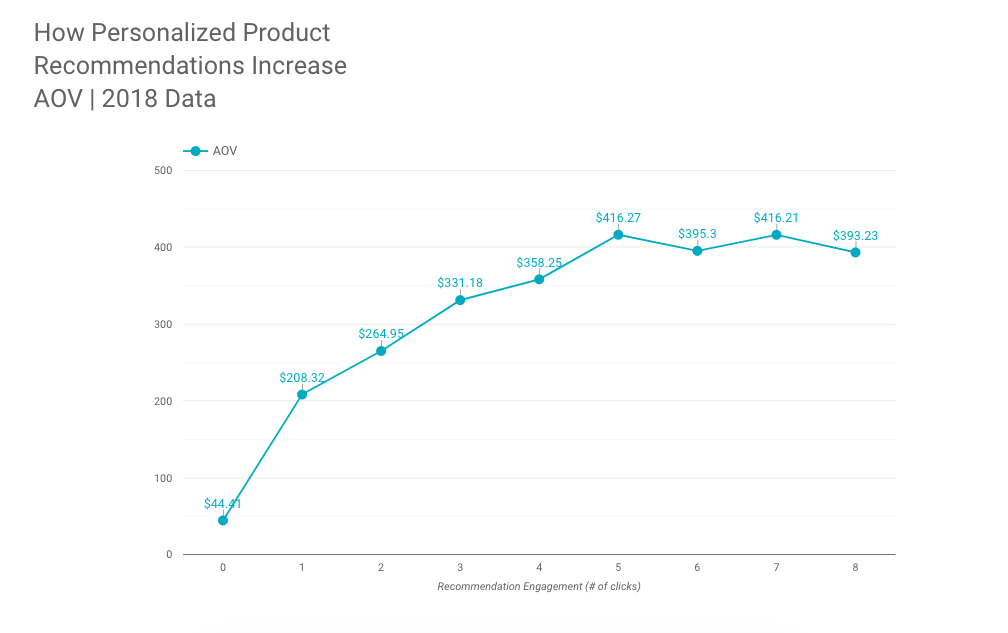

Experience personalization can also help to boost customer lifetime value by increasing average order value (AOV) and purchase frequency.

The image below shows an increase in AOV as the users engage with the brand’s personalized recommendations. We can see a steady increase in the AOV with the number of engagements, with the graph tapering around five clicks.

In another study by Adobe, the interviewed companies experienced a 10% uplift in AOV over three years through highly optimized personalization engagement with improved targeting and messaging to high-value segments.

| Here are some more stats proving that customers also want a personalized experience from brands:91% of customers prefer brands that provide relevant offers and recommendations.80% of customers are more likely to purchase from a brand that provides personalized experiences.82% of customers feel more positive toward a brand after reading customized content. |

But how do you target the audience with personalized content?

- Use retargeting tools like Picreel for targeting visit behavior and actions to show personalized offers and deals. For example, show a discount code to an exiting website visitor.

- Recommend products based on the customer’s search and purchase history.

- Segment users based on their purchase behavior and spend to create personalized campaigns and target them.

- Collect feedback from your potential prospects using surveys. You can then channel these insights to find the right opportunity and value proposition to turn them into customers.

- Segment users by channels and use push notifications to deliver the deals and offers through suitable mediums.

| Tip:Before implementing the personalization campaigns for different customer segments, calculate the CLV: CAC for each segment to find the target audience. |

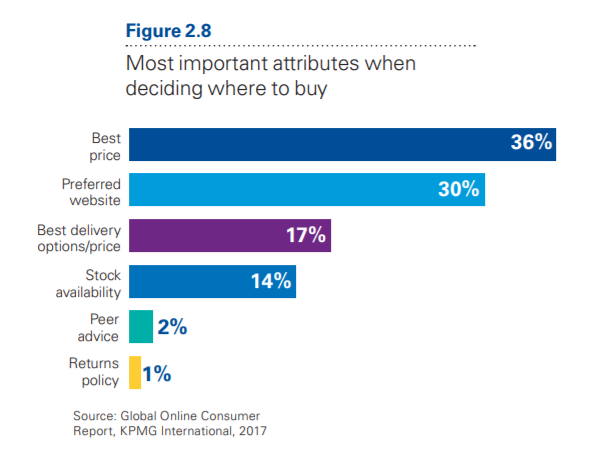

Run Pricing Analysis

According to a 2017 report by KPMG, product price is the number one factor among customers while making purchase decisions.

Not only that, 92% of customers state price and value are the top reasons that affect brand loyalty.

We know that high-value customers contribute the most towards the customer lifetime value. Then there are other customer segments with lower spends per order but with the potential to provide comparable lifetime value over a long-term relationship with the brand.

That’s why it makes sense to run a pricing analysis on your product to find ways to maximize its reach to different customer segments.

For example, you can segment the prices according to company size to make your product available for small, medium, and large businesses. Each tier can have unique perks or product features to justify the pricing.

Providing affordable pricing without compromising the product value has two pronged effect:

- Grows your customer base which means an increase in the number of orders and overall revenue.

- Improves the retention rate, which translates to a longer average customer lifespan and improved customer loyalty.

The net effect trickles down to an increased overall customer lifetime value which means more profits.

- Streamline the Sales Pipeline

A sales pipeline helps to visualize the journey of potential buyers as they move along the conversion funnel. Cultivating long-term customer relationships start from the time the prospect enters the sales funnel.

Streamlining the sales pipeline can help you boost customer CLV by limiting customer drop-offs. Say bye-bye to loss of potential high-value customers due to mismanagement or miscommunication.

Here’s how you can streamline the conversion process:

- Choose a robust CRM software to track and nurture every lead.

- Various CRM tools like BIGContacts can help you organize and automate interactions with your prospects from a single dashboard.

- Follow up with high LTV cold leads and find the reason behind their inactivity. You can then take the necessary steps to push them towards conversion.

- Document every conversation in one place to let other team members know the current status of the prospects.

- Show the actual value of your product in solving the customers’ problems to earn happy customers from the get-go.

Upsell & Cross-Sell

If there’s a sales technique that immediately affects the average order value and thus customer lifetime value, it’s upselling and cross-selling opportunities.

When targeted to the right audience, upselling and cross-selling can influence customers’ buying decisions and boost the order total.

Here’s how you can explore upselling and cross-selling opportunities to boost CLV:

- Personalize product recommendations to show the relevant complementary products to the customers. You can also use AI-powered product recommendation engines to improve targeting.

- Add sections such as ‘frequently bought products’ and ‘people also brought’’ to the product page to persuade customers to add more products to the cart.

- Add credibility and value to your products with customer reviews and ratings.

- Show the latest trending products to the customers.

- Create product bundles by combining popular products with slow-moving inventory to increase the purchase value.

Release Regular Updates and Design Product Roadmap

Whether You host a website, app, or SaaS product, it needs to evolve to keep customers and users engaged. If you don’t do it, your competitors will, and the customers will flock to them.

Engagement that adds value to customers’ time and experience can help keep them with you longer. So, work on the product and services to improve them continuously.

It can include a complete overall of your product UI or a simple new feature that makes it easier for users to achieve a certain goal.

Another strategy that works in improving customer engagement is to give a taste of premium features or new upcoming functionality.

For example, Youtube allows premium users to use and test new features before they are released to the public.

In the same way, Microsoft offers the Insider Program for developers and users to experience their lasted releases in the beta stage and provide suggestions.

Always Follow up With Customers and Users

One of the key customer frustration points is the gap or delay in communication. You might be busy resolving the customer’s problems or innovating your platform, but if they are not updated regularly, they might switch to another brand.

In fact, customers are more likely to remain with your brand if they are proactively updated about the status of their complaints.

The same goes for your product roadmap. If the users are aware of your plans to improve the product further, they are more likely to stick around for longer.

Here’s how to do it:

- Use a robust helpdesk tool like ProProfs HelpDesk to establish a communication channel

- Send an acknowledgment mail to the customers who reach out to you through the helpdesk ticket.

- Follow up with customers regularly to update them about the progress of their issues.

- Send notifications about new updates and features. You can include these in your monthly newsletters.

- Send alerts about the upcoming payment, overdue, and subscription renewal status.

Find Customers’ True Worth Today to Plan Tomorrow’s Strategies

Now that we know how to implement an effective customer lifetime Value or CLV model into your system, it’s time to take action.

Your loyal customers are the ones that support your entire business with recurring revenue. So start by identifying such high-paying customer segments. These would be the ones who have been with you for a long time and the new ones with the potential to become long-term revenue streams.

Then target these customer segments to increase the purchase value and the time of their association with your brand.

You can use UX research tools like Qualaroo to collect behavioral and psychographic data on ideal customer profiles to build marketing and optimization strategies. Also, collect regular feedback to ensure they have a seamless experience across their customer journeys.

From there, you can start assessing the projected revenue and profit from various segments. It will also help you see where and how much money to pour into your acquisition efforts.

A win-win for you and your customers!

And if you already have a CLV database, use the strategies mentioned above to build upon it to increase the revenue and customer base.

Frequently Asked Questions

What is the lifetime value of a customer?

Customer lifetime value or CLV is the metric used to estimate the total profit a customer would generate for the time they are associated with the brand or company.

How is CLV calculated? How do you determine customer lifetime value?

There are several ways to calculate CLV. The most common method is multiplying the average order value by the average customer lifetime (AOV x AL).

Why is CLV important for businesses?

Customer lifetime value or CLV helps forecast profits, identify the most profitable customer segments, balance acquisition costs, and perform value segmentation.

Can CLV be used to predict future customer behavior?

Yes, Customer lifetime value (CLV) can be used to predict future customer behavior like churn probability. It can also help to predict customer loyalty by estimating the average lifetime of different customer segments.

How can businesses increase their CLV?

There are multiple ways to boost CLV for a business, like building a customer loyalty program, providing a seamless service experience, identifying upselling and cross-selling opportunities, and collecting customer feedback.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!